Market Updates

M&A and capital markets: Australia’s week in review

Dealmaking momentum remains strong across tech, capital markets, and climate financing.

Private equity hits a wall: Fundraising at a seven-year low

Private equity fundraising has slumped to its lowest level in seven years, with global capital raised at US$592 billion. High interest rates, stalled exits and oversupply of managers are weighing on the sector, leaving investors reluctant to commit despite discounts.

Australia’s labour government letting us down in the AI race

The U.S. is racing ahead with bold AI reforms, while Australia’s cautious approach risks leaving its growing AI sector behind.

Australia’s economic recovery is slow and uneven but full of risk and opportunity

Economic cycles come and go, but those who adapt fastest to structural change demographic, technological, and geopolitical will shape the future.

Australian M&A & capital markets wrap

Australian M&A activity remains buoyant across infrastructure, resources, technology, gaming and healthcare, with private equity and strategic buyers seizing opportunities despite a shifting capital markets backdrop.

Gold’s big drop — Trump’s trade games in full swing

Gold prices saw their biggest fall in three months as Donald Trump ruled out bullion tariffs, extended reduced Chinese tariffs by 90 days, and fuelled hopes for a Ukraine ceasefire. While prices cool, Australian miners remain cash-rich thanks to currency gains.

Is private equity fatiguing?

Private equity fundraising has plunged, private credit is slowing, and liquidity is scarce. Capital is rotating to hedge funds and digital assets as investors chase flexibility, transparency, and speed in a shifting macro environment.

Macquarie AGM: A clean sweep & a clear signal from investors

Macquarie’s latest AGM sent shockwaves through the financial world—executive pay challenged, succession plans unclear, ESG pressure rising, and investor activism louder than ever. Is this a turning point for corporate accountability in Australia?

Watch this space!

Today, I had the absolute privilege of filming with the incredible Justin Smith from Ansarada—not just our go-to M&A dataroom partner, but a true ally in championing women in finance. We’re thrilled to share more soon about how this collaboration is amplifying impact and elevating the voices that matter.

M&A roundup - exciting times in the Australian M&A landscape

Australia’s M&A activity is gaining momentum, driven by strategic acquisitions, competitive bids, and growing international interest.

Australian venture capital: Q2 2025 snapshot

The market is tough, but opportunity is real for founders who are lean, early, and AI-savvy.

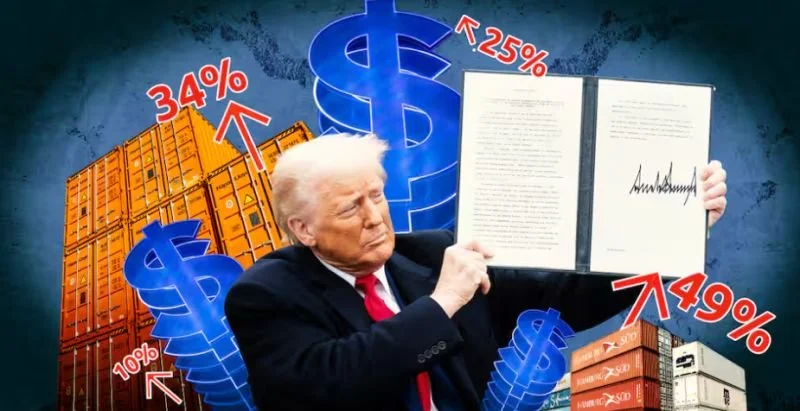

Are markets on edge: Tariffs, tech, and tumbling stocks

Global markets are on edge as U.S. tariff hikes, tech disruptions, and mixed macroeconomic signals send shockwaves through stocks, commodities, and currencies. From tumbling airline shares to surging oil service stocks and record-breaking Bitcoin highs, investors are scrambling to read the tea leaves in a volatile financial landscape.

Australia’s M&A market: A tale of two halves

Australia’s M&A market revealed a year of contrasts—an active first half driven by strategic deals, followed by a slower second half amid rising rates and regulatory pressure. Despite the shift, targeted opportunities persisted in resilient sectors like infrastructure and healthcare.

The AI talent war heats up as Meta challenges OpenAI

Will innovation be won through agility and vision, or will deep pockets and prestige prevail?

All eyes on VIRGIN AUSTRALIA

Virgin Australia’s long-awaited ASX return sparked excitement, with shares surging 8.3% on debut. The $685 million IPO was oversubscribed, underscoring institutional confidence in the airline’s post-restructure growth under Bain Capital. Now holding a 35% domestic market share, Virgin’s revival also hints at broader IPO market recovery in Australia.

Power plays and paydays

Silicon Valley is abuzz as Meta, under pressure to stay relevant in the AI arms race, is offering jaw-dropping $100 million sign-on bonuses to top developers — just to get them in the door. Meanwhile, Australia’s corporate landscape is undergoing its own shakeup, with activist investing gaining traction and reshaping how deals get done. From Nufarm to Lendlease, activist investors are no longer just shareholders — they're strategists with playbooks, pitch decks, and M&A agendas.

Global growth lifted as markets brace for political crosswinds

S&P Global has revised its global growth forecasts upward, buoyed by resilient Q1 activity and looser financial conditions — but the fragile calm may not last. Geopolitical flashpoints and looming U.S. policy decisions could still derail momentum.

Time management for CEOs: a review of Vistage’s ultimate toolkit

In a world where every minute counts and leadership never sleeps, effective time management isn’t a luxury—it’s a leadership imperative. I recently explored The Time Management Toolkit for Busy CEOs by Vistage, and it’s easily one of the most practical, strategy-packed reads I’ve come across for executive productivity. This isn’t just theory—it’s a distillation of real habits, data, and expert tactics grounded in 60+ years of coaching experience.

Navigating shifts in tech, investment and global leadership

Global shifts in technology, investment flows, and political influence are reshaping priorities—from DEI funding declines to billion-dollar bets on AI infrastructure and crypto-fueled political war chests.